What Are Options?

Vanilla Options Explained

Vanilla options are contracts giving traders the right to buy or sell a specified amount of an instrument, at a certain price, at a pre-defined time. When trading vanilla options, the trader has the power to control not only the instrument and the amount he trades, but also when and at what price. Options can be traded for over the course of a day, a week, a few months or even a year.

Options’ trading is a mystery for many people. Many would choose trading spot over options because of its seeming simplicity, but once they get into options – traders get hooked. The variety of choices, with the ability to control all aspects of a trade, properly balancing risks and rewards, welcomes traders to an exciting world where they have more control over their activities.

Key Vanilla Options Terminology

It’s important to know the key terms that we use when trading vanilla options. There are two types of options which you will trade:

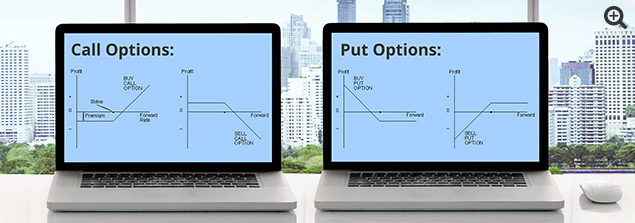

- Call options, which give the buyer the right to buy an instrument at a specified price. Call options are more typically bought by traders who believe the market is on the rise, known as bull traders.

- Put options, which give the buyer the right to sell the instrument at a specified price. Put options are bought by traders speculating the market will go down or bear traders.

You can either buy or sell either type of option.

In order to own an option, the buyer pays the seller an amount called the premium. When the trader acts as the buyer, he pays the premium, and when selling an option, he receives it. The premium is decided by a few factors; the current rate or price of the instrument is the first one. In addition, since options are contracts to trade in the future, there is a time element in play. The date on which the option can be exercised is called the expiration date, and the price at which the option buyer can choose to execute is the strike price. Longer-dated options have higher premiums than shorter-dated options, much like buying insurance.

Market Volatility

Another key factor in determining the premium is the volatility of the underlying instrument. High volatility increases the price of the option, as higher volatility means there is a greater likelihood of a larger market move that can bring about profits – potentially even before the option has reached its strike price. A trader can choose to close his option position on any trading day, profiting from a higher premium, whether it has risen due to increased volatility or the market moving his way.

| AN INCREASE IN: | CALL OPTIONS | PUT OPTIONS |

|---|---|---|

| Spot | + | – |

| Strike Price | – | + |

| Expiration Date | + | + |

| Volatility | + | + |

The Basics of Vanilla Options Trading

When buying an option – whether a put or a call – the trader pays the upfront premium from his account’s cash balance, and his potential earnings are limitless. When selling options, however, a trader receives the premium upfront into his cash balance but is exposed to potentially unlimited losses if the market moves against the position, much like the losing side of a spot trade.

To limit this risk, traders can use stop loss orders on options, just like with spot trades. Alternatively, a trader can buy an option further out of the money, thus completely limiting his potential exposure.

When buying options, there is limited risk; the most that can be lost is what you spent on the premium. If you are selling options, which can be a great way to generate income – the trader acts like an insurance company, offering someone else protection on the position. The premium is collected, and if the market reacts according to the speculation, the trader keeps the profits he made from taking that risk. If wrong, it is not much different than being wrong on a regular spot trade.

In either case, the trader is exposed to unlimited downside, and therefore can close out the position (with stop-loss orders, for example), but with options, the trader will have earned the premium, a real advantage vs spot trading.

Start trading real options with a regulated broker!

Steps in Vanilla Option Trading

- The first step in trading options is to determine the market view for the chosen instrument. If a trader believes a certain instrument will rise, he has three ways to express that view. The first would be to buy the instrument outright, i.e. with regular spot trading.

- The second is to buy a call option. With this strategy, the most he can lose is the premium, paid upfront. This position can be sold at any time. This is the safest way to express a bullish view.

- The third course of action is to sell a put option. If the instrument is higher than the strike price at expiration, the option will expire worthless – and the trader keeps the entire premium he collected upfront.

Example Trades

Scenario: The current price for the EURUSD pair is 1.1000. The trader speculates it will rise within the week

Spot trade: In the first case scenario he will open a spot position for 10,000 units, on the platform at the given spreads. If the EURUSD price moves higher, he instantly makes a profit.

Buy Call Option: In the second strategy, he buys a call option with one week to expiration at a strike price, for example, of 1.1020. Once buying, he pays the premium as shown in the trading platform, for example, 0.0050 or 50 pips. If at the expiration date, EURUSD exceeds the strike price, he will earn the difference between the strike price and the prevailing EURUSD rate. His breakeven level will be the strike price plus the premium he paid up front. He can also profit at any time prior to expiration due to an increase in implied volatility or a move higher in the EURUSD rate. The higher it goes, the more he can make.

For example, if at expiration the pair is trading at 1.1100, his option will be 0.0080 or 80 pips “in the money”, and his profit will be 80 pips minus the premium he paid of 50 pips. On the other hand, if spot is below the strike at expiration, his loss will be the premium he paid, 50 pips, and no more.

Sell Put Option: In the third case, he will sell a put option. Meaning he will act as the seller, and receive the premium directly to his account. The risk he takes by selling an option is that he is wrong about the market – and so he must be careful in choosing the strike price. He should be comfortable in his view that EURUSD will not be below this level at expiration.

Another way to say it is that he must be comfortable buying EURUSD at the strike price because if spot finishes lower, the seller has the right to “put” EURUSD to him at the strike price. In return for taking this risk, the option seller receives the upfront premium. If spot finishes higher than the strike price, he keeps the premium and is free to sell another put, adding to his income earned from the first trade.

In both options trading examples, the premium is set by the market, as shown in the Options trading platform at the time of the trade. The gains and losses, based on the strike price, will be determined by the rate of the underlying instrument at expiration.

Start trading real options with a regulated broker!

Why Trade Options?

Risk management

Options are considered a safe investment for an option buyer, and are far less risky than trading the underlying instruments because your downside is limited to the premium you paid. For a seller, the downside risks, too, are less than that of being wrong on a spot trade, as the option seller gets to set the strike price according to his risk appetite, and he earns a premium for having taken the risk. Options do require an initial investment of time, to get to know the product.

In addition, options can be used to hedge spot positions, and as a result, risks are limited to the premium amount. For instance, if you have a long position on an asset, such as a stock, you can buy put options to hedge that underlying position. Put options rise in value when the underlying asset’s price declines. So, if your long spot market position is generating a loss, your put option position will generate profits, effectively protecting you against market swings.

Express any market view

Perhaps the most unique advantage of options is that one can express almost any market view, by combining long and short call and put options and long or short spot positions. The trader is bearish on USDJPY, but he is still not sure. He can buy a put option for his target expiration date, sit back and relax. Whether USDJPY goes up or down tomorrow, he is safe in his position all the way to the expiration date. If he turns out to be right, spot is lower than the strike price by at least the premium value, he will earn profits.

Multiple Strategies:

Like any instrument, trading options has its risks and potential losses. However, there is a major difference between trading spot and trading options. In spot trading, the trader can only speculate on the market direction – will it go up or down. With options, on the other hand, he can execute a trading strategy based on many other factors – current price vs strike price, time, market trends, risk appetite, and more, i.e. he has much more control over his portfolio, and therefore more room for manoeuvre.

A major risk in trading financial derivatives is volatility. Volatility may occur as a result of various factors, such as major news and events that have a direct impact on the underlying asset’s price.

Strangles and Straddles are the most efficient options trading strategies applied for volatility trades. Strangles are applied when there is a directional bias, while Straddles are applied when the expected price direction is unclear. In both strategies, though, options traders ensure that their speculative bets are hedged. Strangle and Straddle strategies can be applied in the following ways:

- In a long strangle, a trader buys both call and put options with similar expiry times, but different strike prices. This way, the profit potential is theoretically unlimited, but the maximum risk is the premium of the two option contracts.

- In a long straddle, a trader buys both call and put options with similar expiry times as well as identical strike prices. Likewise, the maximum risk is defined, while profit potential is unlimited if the price of the underlying asset makes big price movements in both directions.

Traders will apply short strangle and short straddle strategies when they expect the implied volatility of the underlying asset to be low. In a short strangle, a trader buys both call and put options with similar expiry times, but different strike prices. In a short straddle, a trader will sell both call and put options of the same underlying asset with similar expiry times and identical strike prices. In both scenarios, profits will be generated if the underlying asset’s price ranges or does not make significant movement in either direction.

Learning Centre

Options are a great tool for any trader who invests some time to understand how they work. Bluesky Brokerage offers a full education section accessed directly from the trading platform

Increased Trading Choices

For an experienced and aggressive trader, options can be used in a myriad of ways. For the beginner or a more conservative trader, long options strategies such as buying options and option spreads, offer a limited risk entry into the market. By using the products and tools offered on the Options platform wisely, this flexibility generates more possibilities for making profits.

Vanilla Options with Bluesky Brokerage

Options is not only a leading platform for trading options but also one that was built with the client in mind. The platform has embedded tools that are available to all clients, and their purpose is to guide and assist you every step of the way. Moreover, the platform is simple to understand and use. Is it highly customizable and contains the key strategies in-built.

With Bluesky Brokerage, you can trade real options with a real broker!